DELIVERING TRUST WITH EMPATHY - WHERE NEXT FOR FINANCIAL BRANDS?

First published in Brandingmag on 27 August 2020. [https://www.brandingmag.com/2020/08/27/delivering-trust-with-empathy-where-next-for-financial-brands/]

Financial brands started the journey to digitization in the late 90s, that in the UK included FirstDirect, Egg, Smile, and ING. Initially used by millennials and lighthouse customers, these brands experienced a slow adoption as consumers continued to shun digital channels in favor of the human side of banks. Consumers bemoaned the closure of branches and the loss in human interaction, believing that digital touchpoints couldn’t be trusted or deliver the empathic side of banking employees.

The arrival of the iPhone in 2007 heralded a more radical shift with the birth of the AppStore that placed the consumer at its very heart disrupting a consumer’s traditional relationship with technology and brands, and putting it within the reach of the average consumer, young and old. Supported by evermore intuitive user design and faster internet connections giving users easier and faster ways of doing online banking and financial services.

However, until March 2020, financial services had continued to miss the mark with consumers and mass adoption, primarily through apathy with the older customer still preferring face to face interaction with companies offering financial services and the younger audiences lacking motivation or need to really embrace the challenger banks.

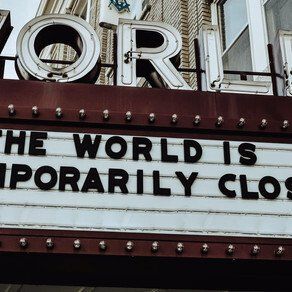

With the advent of the pandemic, the consumer landscape changed, from the way we work to the way we buy and use services, accelerating the adoption of digital touchpoints for many brands, leading to a new emotional journey for consumers that left behind the reliance on face-to-face contact. Balancing trust and engagement that needed to be authentic.

Many of the fintech and challenger brands struggled to reach mainstream banking before 2020, with consumers still migrating towards the high-street banking brands such as HSBC, TSB, and Barclays. The lockdown led to a forced change in behavior, removing the barriers to change – consumers looked to product and service needs as banks and building societies changed their operating rules and pushed consumers to seek alternative options as usability failed.

Leading to a level-up of brands previously not thought possible and certainly not within weeks, starting with the likes of Starling, Atom Bank, and Monzo. But can these brands create an emotional link between their brand and the consumer?

We know that customers who are emotionally connected to a brand are more likely to trust a message that comes from a financial brand they believe in versus one they don’t. Can fintech brands now shed the apathy historically shown by consumers when considering a change in banking services, will consumers see beyond bricks and mortar?

The lockdown has led many consumers to consider many services as they wrestle with incumbent providers that have been slow to understand new customer journeys or provide upgraded or appropriate services. Stuck with inadequate call centers or outdated apps that struggle to replicate the actions of branch staff or engage with the customer, the high-street brands have been left behind as many consumers seek ‘new’ brands that cater to their lockdown needs, breaking down the previous barriers.

Is it apathy or fear that left consumers with the traditional providers? Are we seeing consumers move in different directions as the younger consumers lack the emotional connection to banking brands that many of Generation X and Baby Boomers experienced?

In those days, bank managers were there to support as well as provide products, creating strong emotional ties to brands and even branches. As the high-street banks have retreated from the very place where people sort them out, their emotional connection has also diminished, and Generation Z will almost certainly be the last to have any connection with a bricks-and-mortar branch, although it remains to be seen whether we could move to virtual branch experiences through VR.

Consumers are moving at a pace to the Netflix model of subscription-based services and will their view of financial services change in the same way with bundled and basic ‘freemium’ products driven through apps? Premium services will be activated as the needs arise – going on holiday, add travel insurance, shopping for Christmas, adding heightened consumer protection, or saving for a house.

Consumers engage with brands that understand their lifestyle and life stage. Financial brands really need to understand what matters to their customers – in similar ways to other sectors, consumers demand diverse levels of emotional engagement that can disproportionately influence brand preference.

Next, brands need to understand that they have to be more than just a logo and a great service. To make the brand distinctive, it must have a strategy that drives meaningful differentiation through the culture of the organization and maintain the level of innovation that first attracted the customer to the service in the first place. FirstDirect has successfully remained engaged and connected to its customers from day one, innovating and moving with the times, although even this brand has struggled to genuinely engage with Generation Z, with many still feeling it’s a brand for their parents, leaving this audience to the true fintech and early adopter brands. Can high street brands and the inbetweeners re-capture these customers?

These traditional brands have history, and they also have enormous amounts of data that map and potentially highlight customer needs of the future, driving emotional engagement as they demonstrate customer understanding – when was the last time your bank actually sent you something that was truly relevant and engaging? Aside from the standard product mailing that tends to be connected to your account type – premier, advantage, etc. – there is little in the way of emotional engagement.

Could banks do better by not trying to be all things to all people/customers? M&S clothing tries to offer something for everyone but in the age of the web, consumers don’t need a one-stop-shop, they can buy from anywhere literally in the world. Are banking brands making the mistake of trying to capture a customer for life? With switching being so easy and quick, should we be encouraging customers to choose brands relevant for their lifestyle and stage? The high-street banks have tried to engage with Generation Z with brands like Bo (developed by RBS), as a customer-facing challenger brand, but was abandoned after only six months after failing to capitalize on the surging popularity of the challenger banks like Monzo and Revolut, which have garnered millions of customers.

Sitting between the challenger and the high-street banks are the apps that automatically link accounts, such as Chip that helps consumers save simply across all their products. Will this lead to banks becoming merely facilitators as consumers migrate to intuitive apps that have no care for where and how they receive money?

Will high-street banks, through their cumbersome processes, lose their interface with customers as other providers including the tech giants of Google, Amazon, Apple, and Facebook offer better functionality and usability to the consumer, relegating the banks to dumb conduits for holding customer money? Recent research by PWC showed that almost 40% of bank customers would share their financial data with other banks and third parties, in return for tailored benefits. Although if as we mentioned early considered distinct groups of users, research by Accenture showed that 85% of 18-24-year olds would trust third parties to aggregate their data – in contrast, this nearly halved when talking to 55-64-year olds.

Think about the impact of aggregators in the insurance sector; insurers have been relegated in favor of meerkats, opera singers, and masters of the universe, although I’m not sure this is any different to the old high-street brokers that managed the whole of customer’s insurance needs.

How can the high-street banking brands survive under a changing consumer landscape driven by a rapidly changing technological landscape? If they migrate to older customers, they risk losing long-term customer growth as the younger customers no longer see the banks as a must-have, when their phone manages all their cards, for example?

Closing food for thought and point for another day: How can AMEX, with its titanium cards, retain its brand value when the card migrates to a picture within your iPhone wallet?